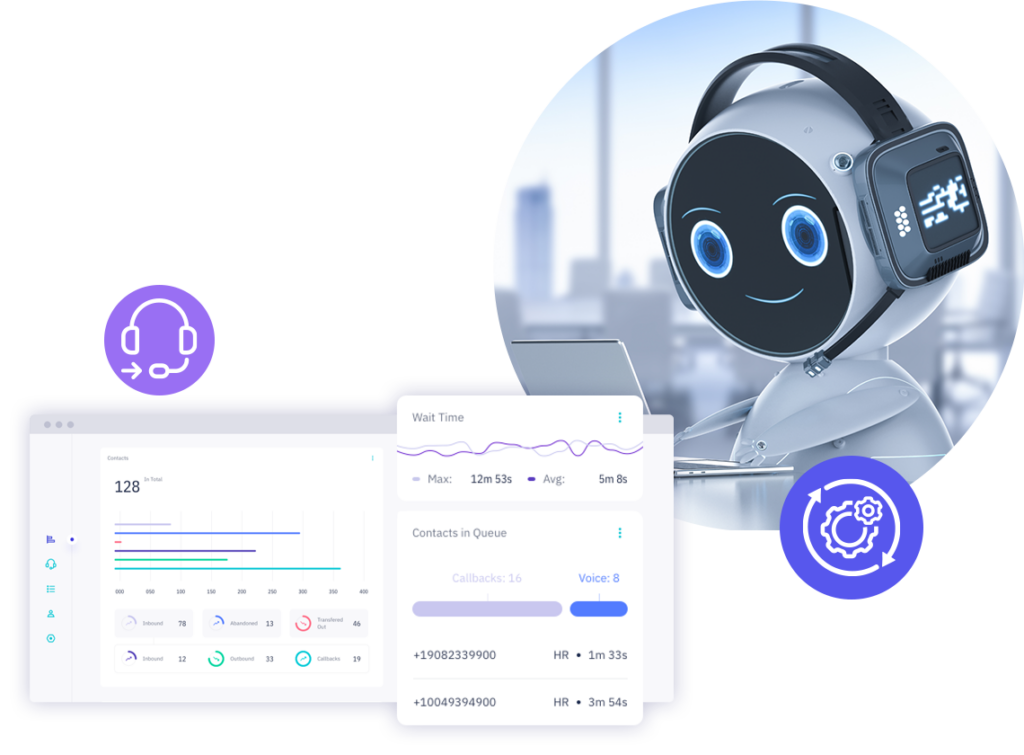

Ready to use AI

Use AI to deliver more personalized experiences, guarantee happy customers, and increase agent performance.

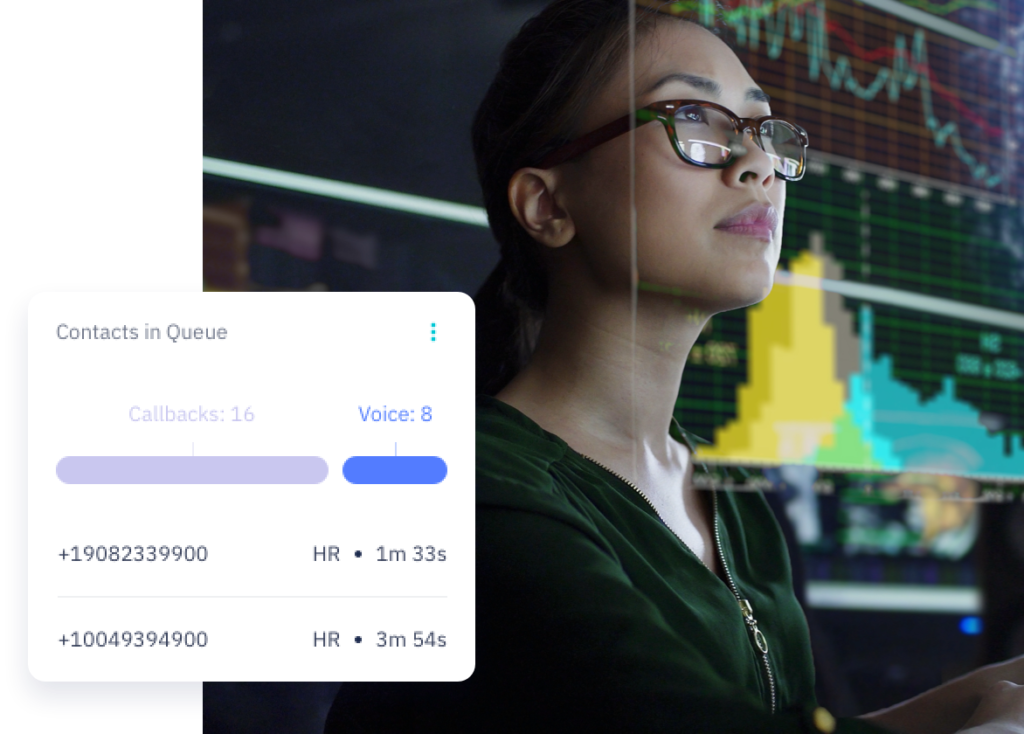

Actionable insights

Full visibility into your communications data with built-in on-demand analytics, so you don’t have to bring your own.

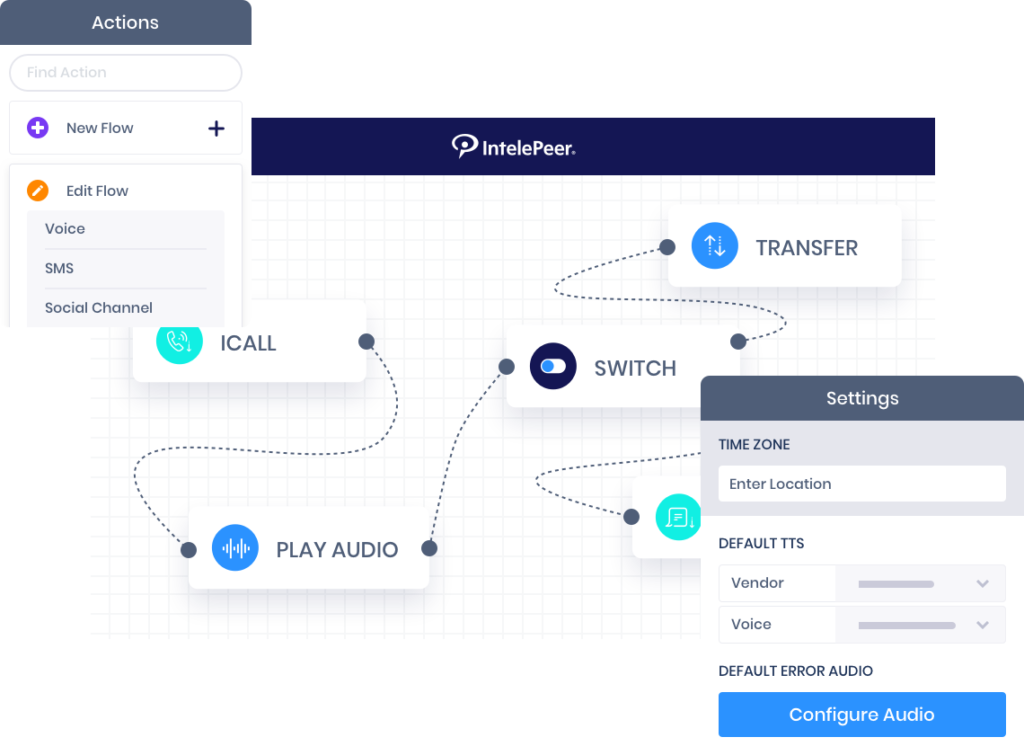

Omnichannel automation

Omnichannel communications integrated seamlessly into your customer experience and business workflows.

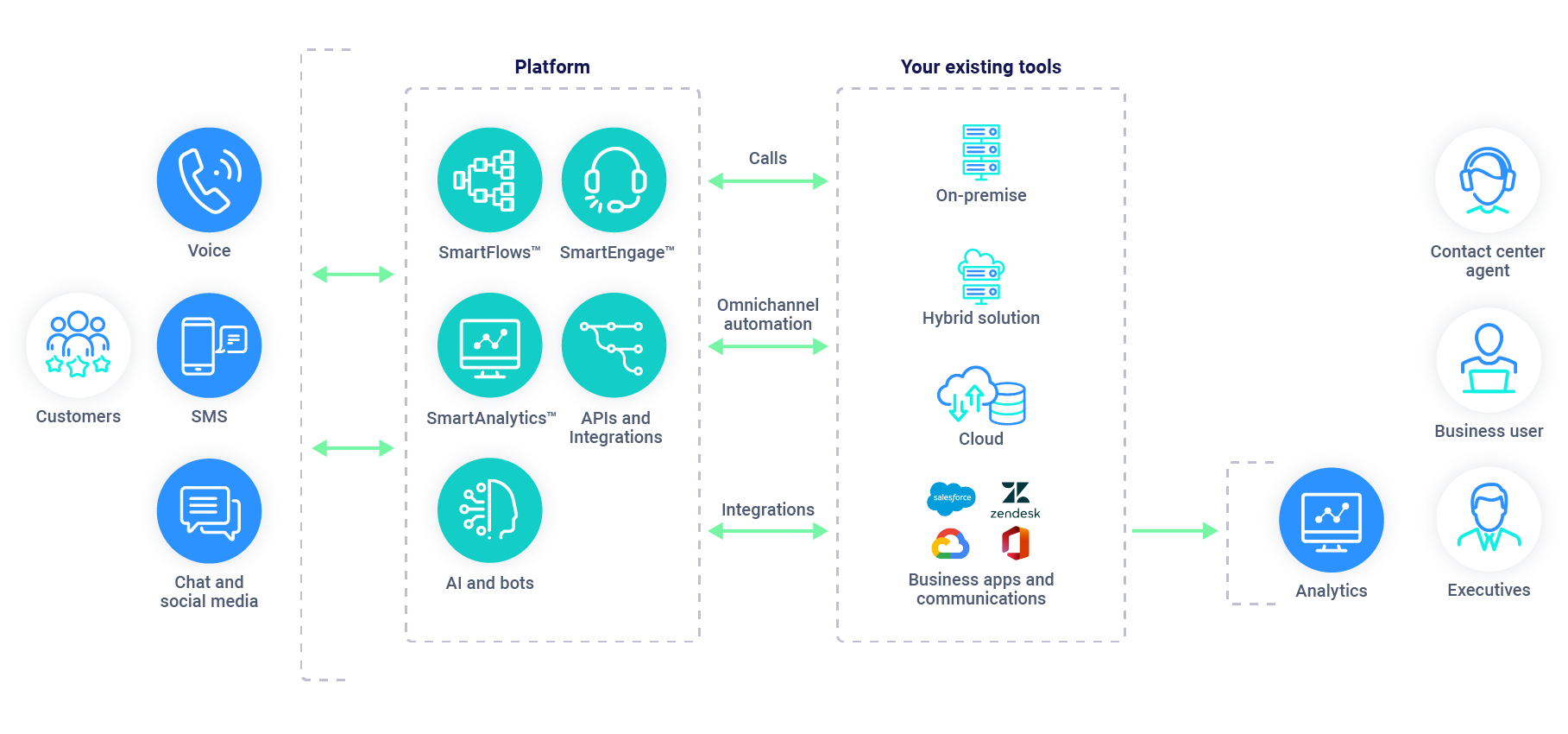

End-to-End Conversational AI Platform

IntelePeer’s end-to-end Conversational AI Platform works seamlessly within existing business software and infrastructure, enabling brands to automate complex processes quickly and effortlessly. Vendor neutral, the platform leverages world-class agentic AI and analytics, empowering businesses to proactively resolve potential pain points and maintain context across channels and throughout the orchestrated customer journey.

Powered by the latest leading technologies, IntelePeer’s Conversational AI Platform seamlessly delivers hyper-automated omnichannel communications across voice, SMS, social messaging, and more.

On-prem, cloud, and hybrid

Layer communications automation over your on-prem, cloud, or hybrid infrastructure to quickly and easily modernize your operations and communications.

Enterprise security and compliance

Safeguard your organization and customer data with powerful, seamless automated fraud prevention.

Ease of use and time to market

Launch in minutes instead of hours with easy-to-use plug and play integrations and workflows.

ROI

Lower the cost of doing business while rapidly improving customer experience with customer-centric communications.

A health insurance company case study: AI and automation are the solution

Challenge: The health insurer was challenged with managing a call volume that was growing by over 200% each year, with over 7,000 agents spread across five different business process outsourcing (BPO) entities, operating in five distinct contact center environments.

Solution: IntelePeer’s Conversational AI Platform for self-service, advanced routing, and back-office integration.

Results: 60% self-service rate | 40M+ calls automated in 2022 | 75%+ call containment achieved with AI | 5,000 concurrent calls reliably automated | 75% reduction in on-prem to CCAAS migration efforts

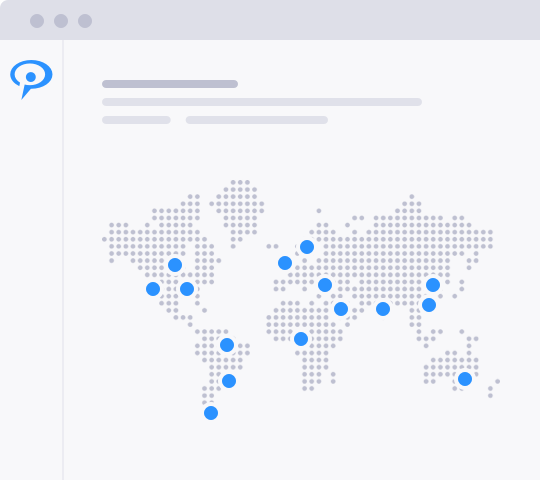

THINK GLOBAL

IntelePeer’s international reach

Countries

200+

Voice and SMS connectivity for wherever in the world your customers take you.

Mobile carriers

800+

Global interconnectivity with leading mobile providers.

Support

24x7x365

We are here to help you 24 hours a day, 7 days a week, everyday of the year.

Compliance

Security

Built to meet the regulatory requirements of the most demanding enterprises including GDPR, HIPAA, PCI, and CDPA.

Experience IntelePeer today

Enjoy the power of IntelePeer in the cloud, on-premise, or somewhere in between.